Why Lic Jeevan Anand Is The Only Skill You Really Need

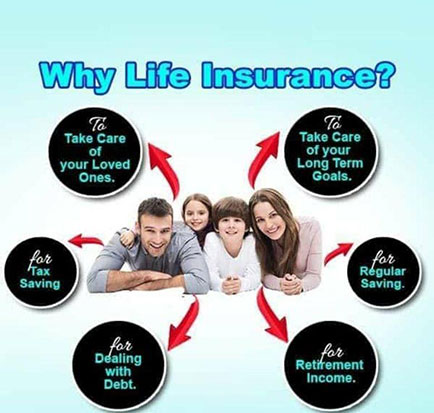

]The LIC Jeevan Anand Plan from LIC is one of the top endowment plans offered by the insurance giant. It is a non-linked endowment plan that offers an attractive combination of protection and savings. This plan provides financial protection against death throughout the lifetime of the policyholder with the provision of payment of a lump sum amount to the […]

Why Lic Jeevan Anand Is The Only Skill You Really Need Read More »