Financial Planning

Financial Planning

We help our client to achieve their Financial Goals such as:

- Retirement Planning

- Child Education Planning

- Wealth Creation

- Income Protection Plan

Retirement Planning

To have a comfortable, secure—and fun—retirement, you need to build the financial cushion that will fund it all. The fun part is why it makes sense to pay attention to the serious and perhaps boring part: planning how you’ll get there.

Planning for retirement starts with thinking about your retirement goals and how long you have to meet them. Then you need to look at the types of retirement accounts that can help you raise the money to fund your future. As you save that money, you have to invest it to enable it to grow. The surprise last part is taxes: If you’ve received tax deductions over the years for the money you’ve contributed to your retirement accounts, a significant tax bill awaits when you start withdrawing those savings. There are ways to minimize the retirement tax hit while you save for the future—and to continue the process when that day arrives and you actually do retire.

LIC of India is having various policies get into all of these issues here. Everyone should take a LIC Policy, no matter what their age, to build a solid retirement plan.

Plan your Happy Retirement Today with a LIC Policy!

Child Education Planning

Providing children the ideal opportunity for learning and development is foremost among any parent’s goals. Therefore, it’s necessary to carefully plan a children’s education fund. When your child is ready to go to college, you will be ready with the right amount of money and won’t be awed by the high costs of education. Here are some simple steps to take while planning your child’s education fund.

Children’s education is typically a long-term goal, there is high cost inflation here as well. Therefore, you should invest through instruments that provide inflation-beating returns. A long investment tenure allows you to take moderate levels of risk, which can potentially produce high long-term returns. It’s easy to be daunted by the astronomical money requirements. However, while investing towards any goal, you should implement the concept of stepping up.

Start Early

Planning for your child’s education is a long-term financial goal. The best time to start planning for your child’s future needs is when he or she is born. Assuming your child will go to college at the age of 18, you will have nearly two decades to create the right-sized fund for your child’s need. The effect of compounded growth will allow you to achieve this goal with small, monthly contributions.

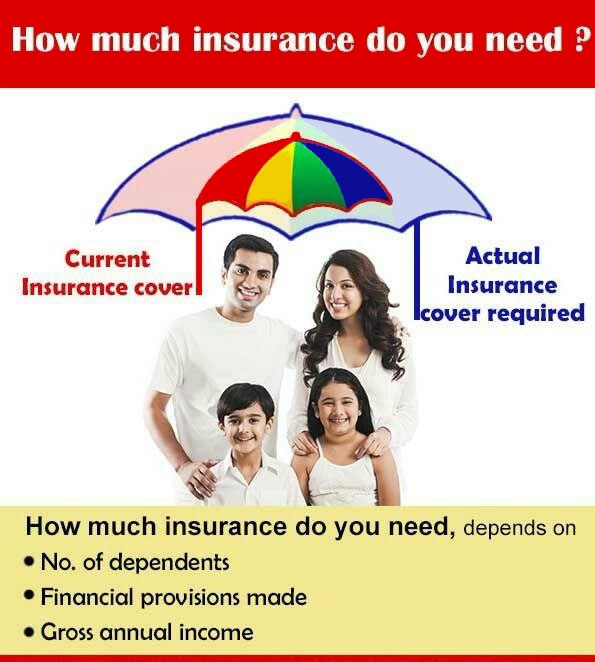

Insure yourself

LIC’s Life insurance should be seen as a protection cover for your family first, though it is also popularly used as an investment. In case of any unexpected event, your life cover should help replace your income, keep your family afloat financially, and help your children achieve their life goals. Your life cover should be at least 10-20 times your current annual income. With LIC insurance plan, you can achieve this coverage requirement and ensure financial safety for your family.

Wealth Creation

You must focus on investing as much as possible for the longer term. The best option is taking a best policy in LIC of India.

The longer you let your money work hard, the more money you take home. If you keep investing your monthly commitment, you will walk away with a large sum. Many millennials ask if they will ever be rich with those small shots of investment every month. Be it a recurring deposit or a systematic investment plan in an equity mutual fund, most financial planners advise investments in a disciplined manner to achieve seemingly unachievable goals depending on the time on hand and the risk profile of the investor. While individuals look for investments offering the highest possible rate of return, the tenets of personal finance however, ask investors to invest as much as possible for as long as possible – Life Insurance Policy.

Income Protection Plan

Ensure your family is always protected – If at some point you have asked yourself, “Who will look after my family when I’m not around?”, you are not alone. It is natural to wonder how the absence of you and your income will affect the financial and hence the emotional stability of your loved ones.

It is with such situations in mind that insurers introduced income protection plans. By ensuring regular income pay-outs, these plans help your loved ones maintain the lifestyle you worked hard to give them, even in your absence.

In LIC Policy Plans, in case of any unexpected event of the insured person, his beneficiaries receive the lump sum amount. However, the beneficiaries may not be equipped to make the most of this pay-out, and may be unable to stretch it over a long period of time.

Income protection plans allows the nominees the flexibility of receiving pay-outs at a duration of their choice. With this there is no fear of the lump sum being misused.

Thus, the basic premise of such plans is to provide an Income Replacement, on any unexpected event of the insured. The beneficiary gets regular monthly income known as monthly benefit for the insured’s entire working life, up to the age of 100 years.

Think! Why you need a Insurance Policy with LIC

Family Head

You are the sole or major earning member of your family

Ensure Regular Income

You want to ensure regular income for your family even if you are not around

Cost of Living

You want your insurance plan to periodically incorporate increasing cost of living due to inflation

Financial Stability

Your loved ones depend on your income for financial stability

Lovable Family

You want your family to be taken care of in case of any unexpected event or disability

Want to know more! Get Your Free Consultation TODAY!

Mrs. M. Porkodi., B.Com., A.I.I.I.,

Development Officer - LIC of India

“It’s all about making the right choice at the right time to be Financially Free and Successful”